Table Of Content

NBC Connecticut reports that, like many states in America right now, Connecticut is starting to face an inventory shortage. That means there isn’t enough supply (houses) to meet the demand (prospective homebuyers). This can make it tough for homebuyers to find the right property at the right price, especially if they don’t act fast.

Typical home price in Michigan: $227,748 (67% of typical U.S. price)

The state also has a progressive income tax, where you pay anywhere from 1 to 13.3 percent based on your salary. This means when you’re out at The Grove and you spend $1,000, you’ll pay $95 in taxes. From routine check-ups to unforeseen trips to urgent care, healthcare costs are bound to pop up intermittently. If this works for you, you can save a lot on transportation costs, not to mention the time you’d have to sit in traffic otherwise.

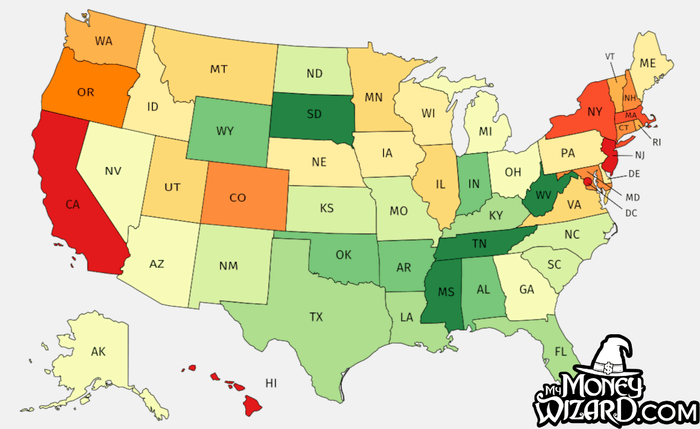

Median home prices in every state

A median household income that is 87% of the national median offsets those low housing costs and results in a below average income-to-home-value ratio. According to the Federal Reserve Bank of St. Louis, the median home sales price is $417,700. That's down $17,700 from the previous quarter and $61,800 lower than the previous year. The average purchase price is$449,182, a 9.6 percent increase from last year. The average home price is $319,888—a whopping 17.7 percent increase over the past year. Phoenix, in particular, has one of the hottest housing markets as of April 2021.

Hidden Housing Gems

Although the average price of a home in South Carolina is $210,727, up 8.7 percent since last year. Some areas are more expensive than others, though—for instance, the average price for a home in Charleston is $366,358. However, the average price for a home in Columbia is $160,405, and a home in Myrtle Beach goes, on average, for $206,449.

These insurance costs often depend on your home, location, discounts, and the types of coverage you’ve opted to purchase. Your insurance costs are usually paid into an escrow account as part of your monthly payment, although it may be possible to pay insurance on your own. To find out, The Balance collected data on home prices, mortgage interest rates, property taxes, insurance, maintenance, and more for 21 of the largest U.S metro areas. The direction and pace at which housing supply changes indicate whether the options for buyers are increasing or decreasing. They can also indicate whether homes are lingering on the market or being sold faster than sellers are listing them. There are currently 1,521,330 residential homes for sale in the United States.

Top 10 Metros in the U.S. with the Fastest Growing Sales Price

Average Cost To Add A Second Story In 2024 – Forbes Home - Forbes

Average Cost To Add A Second Story In 2024 – Forbes Home.

Posted: Mon, 26 Feb 2024 08:00:00 GMT [source]

Homes in Colorado are the sixth most expensive in the nation, and the state has the eighth-lowest income-to-home-value ratio, despite the median household there being 19% above the national average. You might want to save anywhere from 3.5% to 20% of a home’s price for your down payment, depending on your financial circumstances and the loans you’re eligible for. Surprisingly, three of the top 10 counties nationwide where wages are growing faster than home prices—Los Angeles, San Bernardino and Riverside—can also be found in the state. The state’s average price of a home is up to $409,182—which has increased 10.9 percent from last year. Portland offers reliable public transportation, an impressive web of bike trails, and top-notch medical services. The coast, forests, and mountains space offer countless options for recreation.

Factors Affecting Housing Prices

And while NYC’s reputation for being notoriously expensive is certainly justified — the median price in Manhattan is more than $1.3 million, per Redfin — there is much more to this huge state than just NYC. Towns in the Hudson Valley and farther upstate have plenty to offer, at much more affordable prices. Homebuilders have been able to mitigate the impact of elevated home loan borrowing costs this year by offering incentives, such as covering the cost to lower the mortgage rate home buyers take on.

If you’re looking outside of Madison, homes in Kenosha are going for $189,372. The location of a property, mainly residential, is one of the most critical factors that affects its value or price. A good location can significantly increase the price of a property, whereas a wrong location can have a negative impact. Regardless of citizenship, anyone can own a residential or real estate in the USA.

States With the Lowest Median Home Prices

Venture capital investment is a major economic activity in the Greater Boston area, and other important sectors include information technology, biotechnology, and high education. Boston is also home to Harvard and MIT, two of the highest-rated educational institutions in the world. Websites like Zillow and Redfin can show you how much homes have sold for and how much sellers are listing them for in the neighborhoods you’d like to live in. It’s also not a popular tourist destination—with the exception of New Orleans, where the impact of short-term vacation rentals on local communities has been a major point of contention. Kids can play outdoors year-round here thanks to mild winters and 234 days of sunshine annually—well above the U.S. average.

The median income in Hawaii is 20% higher than the median income of the entire US, but the average mortgage payment in Hawaii is still 78.3% of the state’s median income. While generally understanding an area’s living costs is useful, true affordability is an essential piece of the overall puzzle. One way to measure this is with the homeownership expense ratio, which looks at how much of a homeowner’s income goes to housing costs. A housing expense ratio of less than 30% is considered affordable; a ratio greater than 30% is considered unaffordable. For a look at house prices in each state, the median income by state, and housing affordability, read on.

Instead, PITI is typically due on the first day of the second month after closing. Depending on when you close, your first payment could be due a little over a month after completing the purchase, or up to two months later. We’ve included it here as an upfront cost because it is an expense you will have to cover close on the heels of a significant outlay. Real estate is a local game, and you should be sure to look at individual towns and neighborhoods to figure out what works for your budget.

Despite the lower-paying jobs, Arkansas could be a good place to buy a house for the access it provides to outdoor recreational activities and the low cost of living. The cost of homeownership decreased from an average of $1,634 in May 2022 (when we last compiled this data) to $1,558 in January 2023—a decrease of 4.65%. However, the current average is still 5.3% higher than the $1,480 average recorded back when we first compiled this data in October 2021. Learn how much it really costs to own a home in the U.S.’s largest cities, and all of the factors that impact total monthly cost.

No comments:

Post a Comment